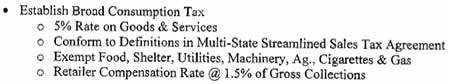

Back when Ben Westlund was pushing a sales tax during his campaign for governor, his campaign sent me a copy of some material they’d developed from a Legislative Revenue Office simulation of the effects of a sales tax in Oregon. The first page brief describing SB382 included this:

The 5% consumption tax Westlund proposed was anticipated to bring in $6 billion of revenue every two years. That would require an annual taxable consumption expenditure of $60 billion. Washington’s sales and use tax gets about half of its income from businesses, so make that $30 billion in personal spending on taxable goods and services.

A couple of things about that. One of the touchstones of the sales tax proponents is that it would garner a huge amount of money from the tourist industry. According to the Oregon Tourism Commission, the tourist industry does about $8 billion of business. According to a state study, more than half of the overnight stays in 2004, however, were from Oregonians travelling in-state. Even if out-of-state travellers spend more than residents when they’re here, the consumption tax on the $5 or $6 billion they spend is just a portion of the $25 billion of the sales tax base that would need to be paid by residents. (I’m going to be generous to the opposition and take all of it out of the personal spending side, although about 20% of travel is business-related and would properly be accounted for in the half of the sales tax related to business. What’s a billion between friends?)

Then there’s the item that tends to get skipped over in most of the talk about various sales tax proposals: “Retailer Compensation Rate @ 1.5% of Gross Collections”. $45 million in payments to retailers just to collect the tax. That’s half the annual funds allocated for the Oregon Department of Revenue in the Governor’s 2007-09 budget ($184 million for the biennium).

Finally, I have to ask, where proponents think $25 billion of annual spending by Oregonians is going to come from. The 2005 Oregon Department of Revenue tax data referenced in my previous post on this topic shows that the sum of adjusted gross incomes for all Oregon returns that year was $83 billion. To make their portion of $3 billion in annual sales tax revenue pencil in (by purchasing $25 billion), Oregonians across the board would have to spend 30% of their incomes on taxable items in the state of Oregon.

If you exclude the 10% of Oregonians with incomes over $100,000/year, the adjusted gross income of the other 90% didn’t even break $50 billion in 2005.

Merry Christmas.